January 2026 market update

Tom Fraser - Feb 05, 2026

January markets reflected shifting trade dynamics, persistent inflation, and rising global risk – all building pressure beneath the surface. Geopolitics, central bank decisions and energy markets contributed to the tremors shaping the investment land

Introduction

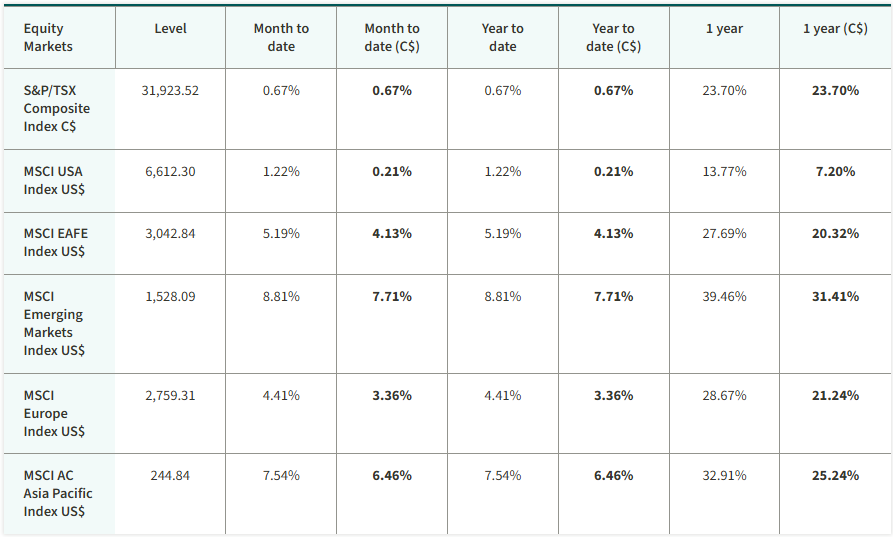

Global equity markets moved higher over the month of January. Tensions around Greenland eventually eased, raising hopes for global economic activity as U.S. and European Union (EU) tariff threats were removed. Enthusiasm for artificial intelligence stocks continued.

The Bank of Canada and the U.S. Federal Reserve Board (Fed) held their policy interest rates steady in January but acknowledged risks from geopolitical tensions, which could hinder economic conditions in the Canadian and U.S. economies. In Canada, the labour market showed more signs of stabilizing, and the unemployment rate in the U.S. fell at the end of 2025. China’s economy expanded in the fourth quarter of 2025, as reported in January, but the pace of expansion was slower than in the previous quarter.

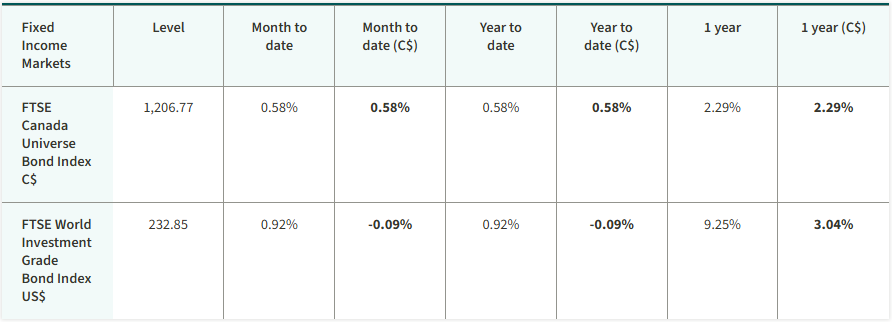

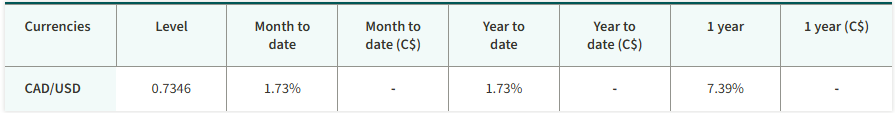

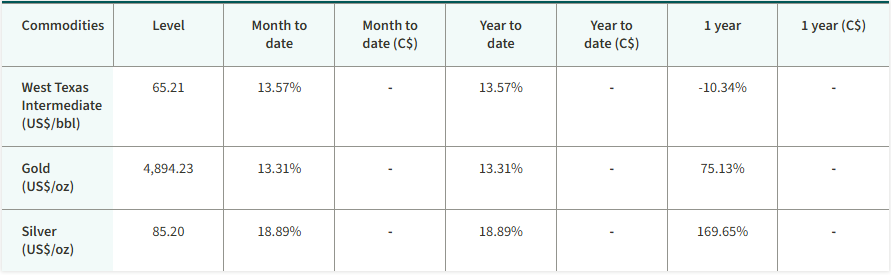

The S&P/TSX Composite Index edged higher, reaching a new record high. The energy sector was the best-performing sector. U.S. equities advanced over the month. Government of Canada 10-year bond yields finished largely unchanged, while the yield on U.S. Treasury bonds increased. Oil and gold prices rose in January. Gold, along with steel and copper, reached new record highs.

Canada and China talk trade

In his efforts to diversify trade and reduce Canada’s reliance on trade with the U.S., Canadian Prime Minister Mark Carney headed to China, where he met with Chinese President Xi Jinping and other senior officials. On the agenda was trade. It seemed to be a relatively successful meeting. Canada and China discussed a framework to increase energy trade and investment. Canada has already boosted oil shipments to Asia. Attention will turn to the construction of a pipeline to boost potential shipments to Asia. The two sides also reached agreement on certain tariff issues. China agreed to lower tariffs on Canadian canola, and subsequently resumed purchases set for the next few months. Canada agreed to lower tariffs on Chinese-made electric vehicles. While Carney felt it was a win for Canada, not everyone did. U.S. President Donald Trump downplayed the arrangement and threatened to impose a 100% tariff on Canadian products if a trade deal with Canada is reached. Trump fears that China could have a pathway to get its cheap goods into the U.S. Canada countered that this wasn’t a full trade deal, just an arrangement to remove prior tariff issues. Markets are left to wonder how this may impact the review of the Canada-United States-Mexico Agreement, which is set to take place this year.

Geopolitical tensions rise over Greenland, Venezuela and Iran

Geopolitical tensions escalated at the beginning of 2026, heightening uncertainty towards the global economy, financial markets and commodity prices. Early in January, the U.S. seized Venezuelan President Nicolas Maduro. After the seizure, President Trump said the U.S. was dedicated to reigniting oil production in Venezuela. He said that he would be responsible for early production and use the proceeds to benefit the people of Venezuela and the U.S. Trump also conveyed his interest in taking over Greenland from Denmark. Since taking office last year, President Trump has been steadfast in his desire to take control of Greenland for international security purposes, particularly from Russia and China. Denmark and the EU pushed back. Trump then threatened tariffs on the EU members if they don’t cede control of Greenland. The EU said it would be willing to impose retaliatory tariffs of its own. Then, at the World Economic Forum, tensions appeared to simmer after Trump spoke with Mark Rutte, Secretary General of the North Atlantic Treaty Organization (NATO). There appeared to be agreement that the U.S. can increase its military presence in Greenland, including the construction of “Golden Dome” missile defence system. The threat of tariffs was then rescinded. Over the month, protests in Iran escalated, largely in response to surging inflationary pressures. The Iranian government took actions to halt the protests, drawing the ire of the U.S. Geopolitical tensions and uncertainty about the global economy helped push several commodities to new record highs, including gold, silver and copper. Gold, in particular, may still see some upward momentum as economic, trade and geopolitical uncertainty linger.

Key U.S. inflation gauges remain elevated heading into 2026

Inflationary pressures in the U.S. remain elevated, with the headline inflation rate and the personal consumption expenditure price index (PCE) still above the Fed’s 2% target. The annual inflation rate was 2.7% in November, while the PCE, which is the preferred inflation gauge for the Fed, was 2.8%. Core pressures also remained elevated. U.S. consumers are also feeling the impact of higher prices, despite resilient spending. In January’s Conference Board Consumer Confidence Index, consumer confidence dropped to its lowest level since 2014 due in part to high price pressures. Consumers noted that gasoline, oil and grocery prices are having an impact on their finances. The path of inflation has caused some division among Fed officials. Some believe inflationary pressures are easing, which calls for more rate cuts. On the other hand, other officials believe inflation is proving sticky and could be above target for a prolonged period. With that in mind, the Fed decided to hold the target range of its federal funds rate steady at 3.50%–3.75% at its January meeting. This ended the cycle of three straight rate cuts. Fed Chair Jerome Powell said the policy interest rate is in a good position in response to the current economic conditions, but the Fed will closely monitor how the U.S. economy evolves amid geopolitical and trade tensions.

Oil market may see a big surplus

Geopolitical tensions and economic uncertainty are making it hard to predict the direction of oil prices early in 2026. One organization says we are likely to face a large global oil surplus. In fact, concerns have been mounting that a global surplus could be forming. In its January report, the International Energy Agency (IEA) projected that the global oil market will be in a substantial surplus over the first quarter of 2026. This is in large part due to the Organization of the Petroleum Exporting Countries and allies (OPEC+) raising production over the second half of 2025 and into January 2026. Late in 2025, OPEC+ did say it would pause its production increases as it saw a surplus forming in the market. The United States, Guyana and Brazil have also raised production significantly. In total, the IEA expects the global supply of oil to exceed demand by 4.25 million barrels of oil per day. However, the IEA did not say that there are risks that could weigh on global oil supply. Tensions have heightened in Iran, which could pressure oil production in the area. And, while Venezuela is expected to see an increase in oil production, supply could be little changed in the short term. Looking at Canada, the energy sector could be hindered by more Venezuelan oil being sent to the U.S. However, Canada’s government is looking to increase oil exports to places like China and India, which may help offset some of the losses. The price of oil increased in January.

Market performance - as of January 31, 2026

This commentary represents Canada Life Investment Management Ltd.'s views at the date of publication, which are subject to change without notice. Furthermore, there can be no assurance that any trends described in this material will continue or that forecasts will occur; economic and market conditions change frequently. This commentary is intended as a general source of information and is not intended to be a solicitation to buy or sell specific investments, nor tax or legal advice. Before making any investment decision, prospective investors should carefully review the relevant offering documents and seek input from their advisor. You may not reproduce, distribute, or otherwise use any of this article without the prior written consent of Canada Life Investment Management Ltd.